Build Credit

Credit Score Resources & Tools

Credit Score Makeup

A breakdown of what goes into your credit score.

FICO Breakdown

-

Payment History (35%): Reflects how reliably you've paid bills on time.

-

Amounts Owed (30%): Measures how much of your credit you’re using.

-

Length of Credit History (15%): The longer you've had credit, the better, showing experience.

-

New Credit (10%): Opening many new accounts quickly can lower your score.

-

Credit Mix (10%): A variety of credit types (loans, credit cards) can boost your score.

Different Types of Scores

Understanding score differences from Custom to FICO to Vantage.

Custom scoring models help financial institutions evaluate your ability to repay loans, creating a more personalized and efficient solution that aligns with your specific financial goals.

FICO Score, developed by Fair Isaac Corporation, is used by lenders to assess the risk of lending money to consumers. It ranges from 300 to 850, with higher scores indicating better creditworthiness.

VantageScore (300-850), by Equifax, Experian, and TransUnion, assesses creditworthiness using factors like payment history and credit usage, aiding those with limited credit histories.

Looking to Improve Your Credit Score?

Take your credit score to the next level with these credit tips:

- Pay Loans on Time: Ensure timely payment of all loans to maintain a positive payment history.

- Reduce Credit Card Balances: Keep your credit card balances low relative to your credit limit.

- Limit New Credit Applications: Avoid frequent credit applications to minimize hard inquiries.

- Maintain Old Accounts: Keep older credit accounts open to lengthen your credit history.

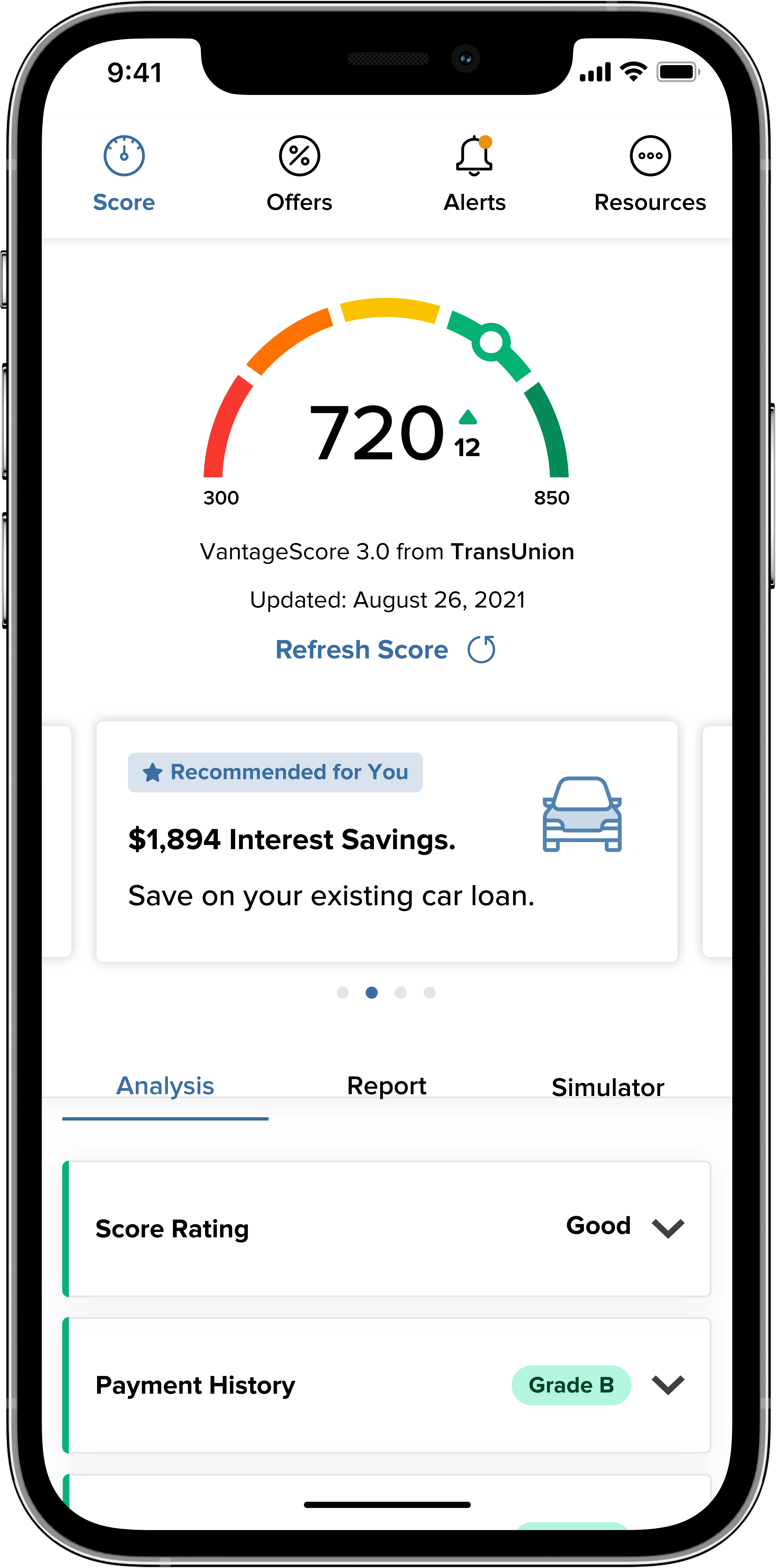

Your Credit Score

Your Credit Score and More

Discover the power of Your Credit Score with Chartway:

- Free credit score, full report, and monitoring

- Daily credit score checks without impact

- Weekly score updates

- Available in the mobile app and online banking

- Score simulator to test financial decisions

- Exclusive money-saving offers

- Personalized tips after setting goals

- Credit Score Action Plan

- Quick financial checkup for budgeting and planning

Get started:

- In the mobile app: Select 'Your Credit Score.'

- Online banking: Go to Online Services and select 'Your Credit Score.' Follow the one-time opt-in.

Not enrolled in mobile or online banking? Use our quick enrollment options to get started.

Empower Your Financial Future

Empower your financial journey with security and confidence, paving the way for a brighter financial future.

For members looking to build credit, this loan lets you save while making payments, accessing funds once paid.

Work with a certified financial coach to review your financial situation to develop a customized budget and money management plan focused on your goals.

Discover financial freedom with a creditworthiness tool unlocking new opportunities.